Endeavor Group Holding is considering strategic alternatives, including a potential sale, due to the difference in its public market value and the underlying value of its assets, although the company has stated that the controlling interest in TKO Group Holdings, which combines UFC and WWE, will not be sold.

Endeavor Group Holding, led by CEO Ari Emanuel, has initiated a review to explore strategic alternatives for the corporation, potentially including a sale. The company, which owns the WME talent agency and various sports properties, announced this development on Wednesday. Emanuel emphasized the need to maximize value for shareholders due to the disparity between Endeavor’s public market value and the intrinsic value of its underlying assets. While the company might consider selling certain parts or the entirety of the corporation, it clarified that the controlling interest in TKO Group Holdings, the merged company encompassing UFC and WWE, would not be up for sale.

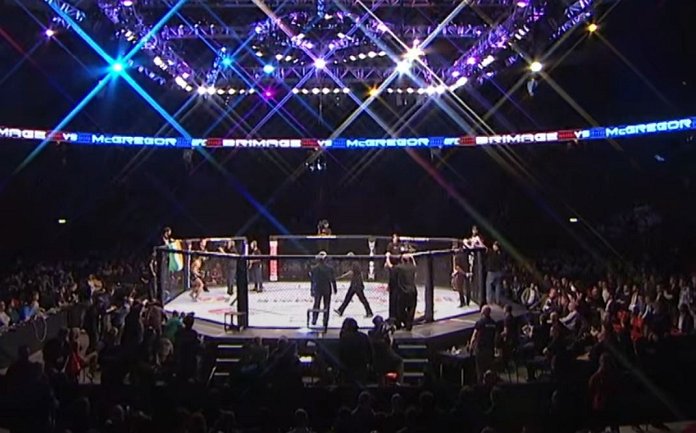

Endeavor recently acquired WWE and then announced plans to spin off the professional wrestling organization and UFC into a new combined company called TKO Group Holdings. With stock prices initially exceeding $100, TKO’s current value stands at $78.64 per share. Emanuel holds the position of CEO over both companies, and TKO is eyeing potential lucrative broadcast rights deals over the next two years, which could significantly enhance its value. Negotiations for their next broadcast rights deal are anticipated to commence in 2024.

Although the WME talent agency generates the largest revenue for Endeavor, the company also owns several other assets, including On Location, a live event and experiences agency, OpenBet, a betting technology company, and Professional Bull Riders, among others. In the past, Endeavor sold off IMG Academy for $1.2 billion, indicating the possibility of similar deals for other assets. Moreover, Silver Lake, a leading private equity firm holding a substantial stake in Endeavor, hinted at the potential for the company to go private again after its recent initial public offering in 2021.

This move comes on the heels of French billionaire Francois-Henry Pinault’s acquisition of a majority stake in Endeavor’s main talent agency rivals, CAA, for $7 billion. Presently valued at $7.79 billion, Endeavor’s market value has declined by 21 percent in 2023. However, the company experienced an 11 percent increase in stock prices during after-market trading. Endeavor emphasized that the strategic alternatives review process does not have a definitive timetable and may not result in a sale.